Latest News

From 22 April 2013, Churches and charities can sign up to make repayment claims electronically using Charities Online. You will need to fill in a new online form which is in spreadsheet format.

Full details can be found on the HMRC website: http://www.hmrc.gov.uk/charities/online/claims.htm

The benefits of the new online system include:

- Faster and more accurate claims

- Acknowledgement of your claim

- Higher limit for aggregated donations

- Making things easier to understand

To make a Gift Aid repayment claim using the HM Revenue & Customs (HMRC) Charities Online Service, you need to record your donations on the Gift Aid schedule spreadsheet, and attach it to your claim.

Use the Gift Aid schedule to record your individual Gift Aid donations, your aggregated donations and claims for sponsored events.

Using Lifetime with Online Gift Aid Claiming

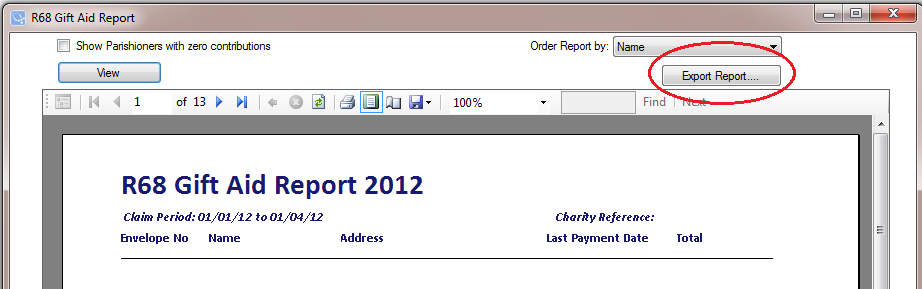

The latest version of Lifetime is fully compatible with the HMRC's online gift aid system. You can export your gift aid report from Lifetime into a spreadsheet which can be copied into the HMRC's gift aid template.

Save your exported gift aid report to your hard disk. When you open it you will find all the required fields to complete the online claim form. Copy the required columns from the Lifetime spreadsheet to the online claim form.

For further information, please contact our support service.